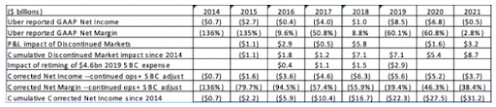

Sobre o desempenho do Uber, que desde 2014 entregou um prejuízo líquido acumulado e corrigido de 31 bilhões de dólares:

The public narrative about ridesharing is that it used innovative technology and powerful network economies to offer consumers much higher service coverage at much lower fares, and that its high corporate valuation was justified by its unicorn-like growth rate and its potential for many more years of robust growth. None of this narrative was ever true, and this marketplace data helps demonstrate that it no longer offers consumers the things that made it popular and has little potential for future growth. But despite this data and $31 billion in losses over twelve years (Uber) and $7.6 billion in losses in the last five years (Lyft) have stopped the business press from continuing to endorse the old narratives. And both companies carefully avoid releasing the operating and revenue data that would make it easier for investors and reporters to question the validity of those narratives.A tabela principal do artigo está a seguir:

Não sei se concordo com a análise. Parece que a estratégia da empresa é mais próxima da Amazon (e da Netflix) que primeiro dominou o mercado, com um rápido crescimento. E depois aumentou seus preços.

Nenhum comentário:

Postar um comentário